Money rule changes from January 1: ITR mandatory PAN-Aadhaar link- All you need to know

|

Getting your Trinity Audio player ready...

|

As India steps into 2026, a suite of financial and regulatory changes have come into force,impacting millions of taxpayers,savers, employees, and everyday financial activities. Among the most significant shifts are mandatory linking of PAN with Aadhaar and updates to Income Tax Return(ITR) filing norms – changes that texpayer can ignore.

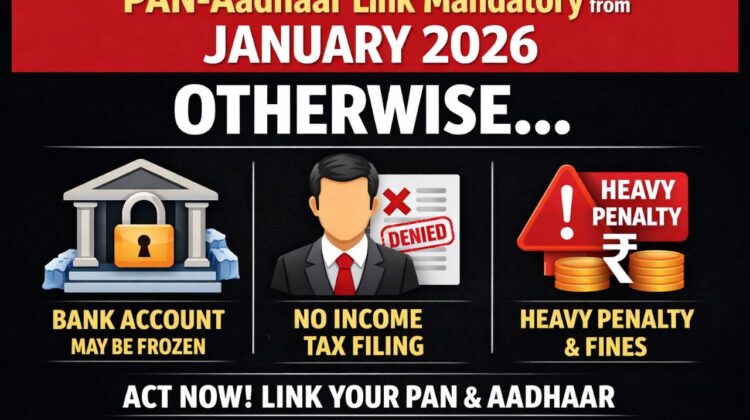

1. PAN-Aadhaar Linking Becomes Mandatory

From January 1,2026, the Government of India has made it compulsory for eligible taxpayers to have their Permanent Account Number(PAN) linked with their Adhaar number.

Why This Rule ?

The move aims to simplify taxpayer identity verification, eliminate duplicate PAN cards, strengthen the tax base, reduce fraud, and tighten compliance. Linking PAN with Aadhaar has been a policy objective for several years,but January 1 marks the point at which non-compliance brings real consequences.

What Happen If You Don’t Link?

If a PAN is not linked with Aadhaar,it will be deemed “inoperative” starting January 1,2026. This doesn’t just remain a technicality – it can disrupt core financial and tax activities:

1.ITR filing will not be allowed using an inoperative PAN.

2. Income tax refunds may be withheld or delayed.

3.Tax deducted/collected at source(TDS/TCS) may be applied at higher rates.

4. KYC transactions( banks, mutual funds, stock markets) may be blocked or rejected.

5. Opening new financial accounts or making investments could be hindered.

This underscores that the inoperative PAN status affects routine life,not just filing returns.

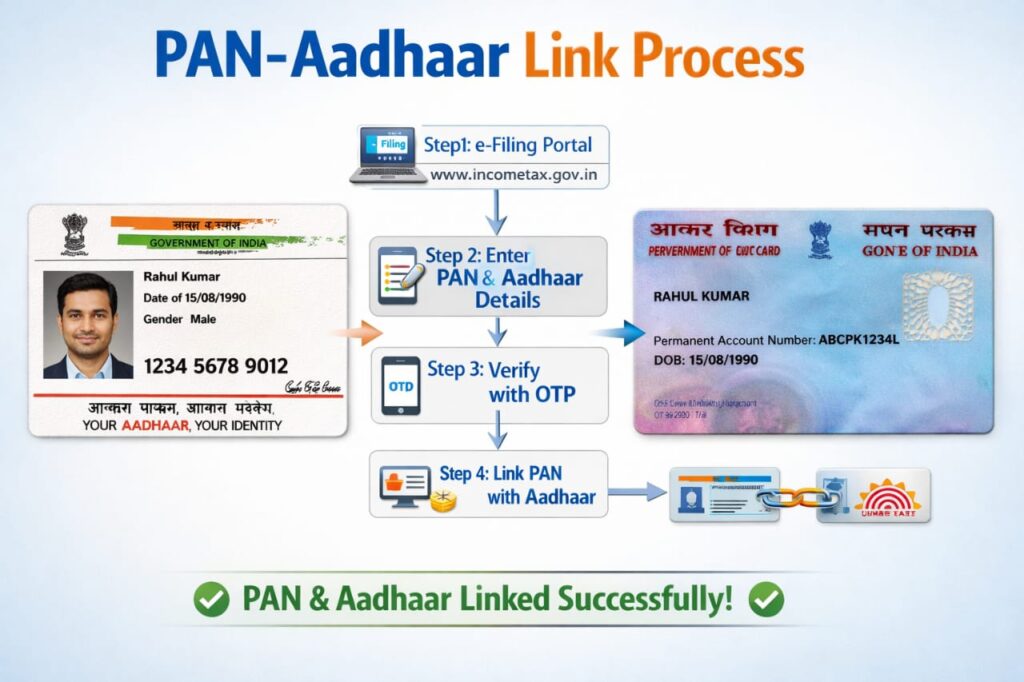

Can You Still Link After January 1

Yes- but with a penulty for late linking before the PAN is restored to operative status. The process is still available online via the income Tax Department’s portal or through SMS and offline options.

Who Needs to Link ?

Every individual who holds a PAN and is eligible for Aadhaar must link the two — especially those who received their PAN via an Aadhaar Enrolment ID before October 1,2024, which was a specific target of the latest deadline.

Certain exemptions exist(such as some NRIs, per Income Tax rules), but for most resident texpayers the mandate applies.

2. ITR Filing Norms and the New “ITR- U”

Another major reform is in the Income Tax Return(ITR) filing process.

Revised and Belated IT Deadlines Ended:—- The Government has ended the window for filing revised and belated returns for the Assessment Year 2025-26 as of December 31,2025. This means from January 1 onward, inaccurate or late returns must follow a new mechanism if corrections are needed.

888slot hỗ trợ chuyển tiền giữa các sảnh – từ thể thao sang slot chỉ mất 1 click, không cần rút/nạp lại. TONY01-12