What is Time Deposit Scheme

A time deposit scheme (also known as a fixed deposit or term deposit) is a financial product offered by banks and financial institutions where you deposit a certain amount of money for a fixed period of time at a predetermined interest rate. Here’s a quick overview:

Key Features:

1. Fixed Term: You choose the deposit duration — commonly 1 month to 5 years (or even more).

2. Higher Interest Rates: Typically higher than regular savings accounts.

3. Penalty for Early Withdrawal: If you withdraw funds before maturity, a penalty or lower interest rate may apply.

4. Guaranteed Returns: Interest is fixed, making it a low-risk investment.

5. Interest Payout Options: Interest can be paid monthly, quarterly, annually, or at maturity.

Example:Deposit Amount: $10,000

Term: 1 Year

interest Rate: 5% p.a.

Interest Earned: $500 (at maturity)

Types:

Regular Time Deposit: Fixed interest and term.

Reinvestment Plan: Interest is compounded and paid at maturity.

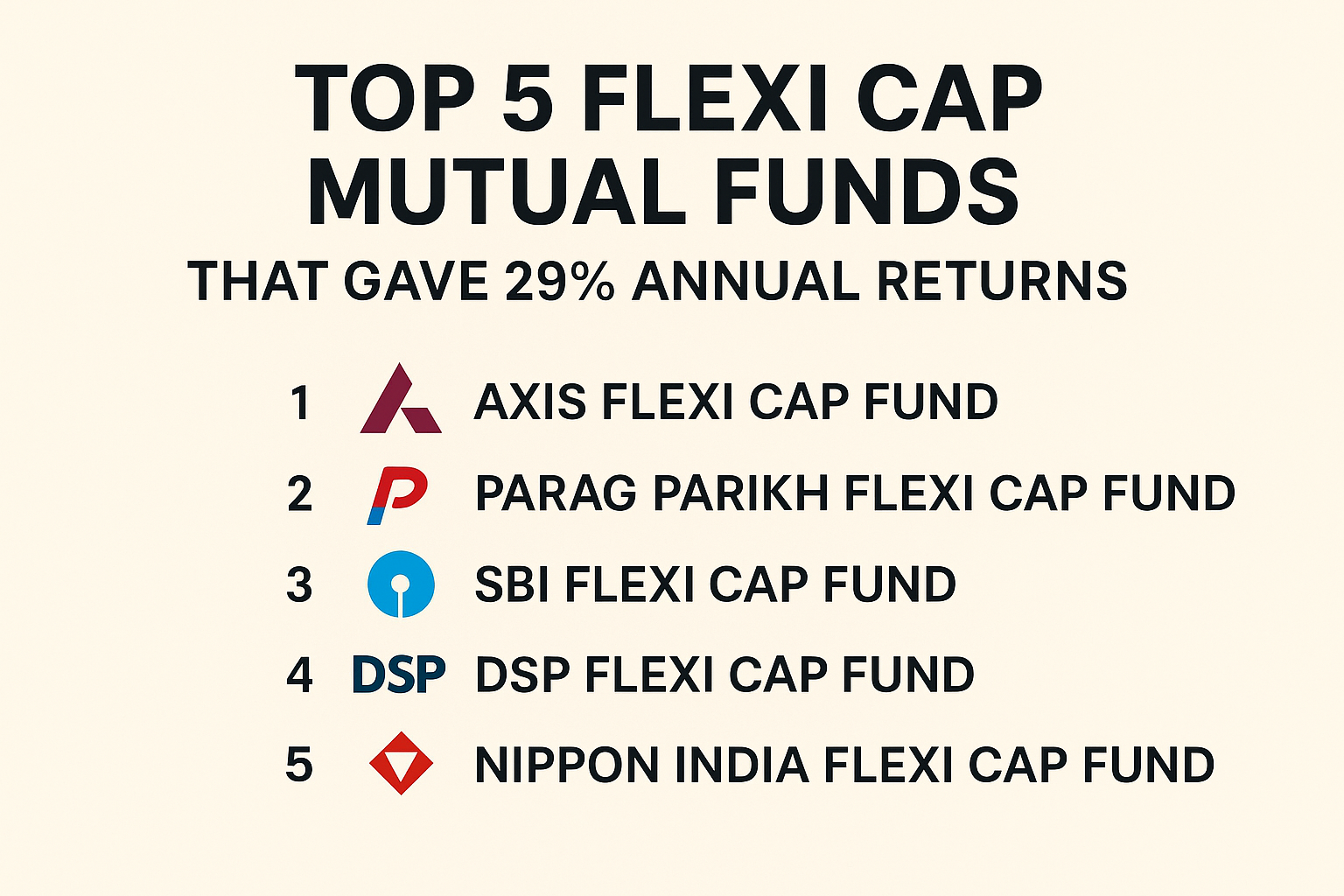

Flexi Deposit: Combines savings and fixed deposit features (usually allows partial withdrawal).

Recurring Deposit: You deposit a fixed amount every month for a fixed period.