income tax return filing due date

|

Getting your Trinity Audio player ready...

|

As the financial year draws to a close, one critical responsibility looms large for every taxpayer – filing your income tax return(ITR). Whether you’re salaried employee, a freelancer ,a business owner oor,a professional, timely ITR filing is not just a legal obligation but a smart financial move. Missing the due date can cost you more than just money – it can cost you peace of mind.

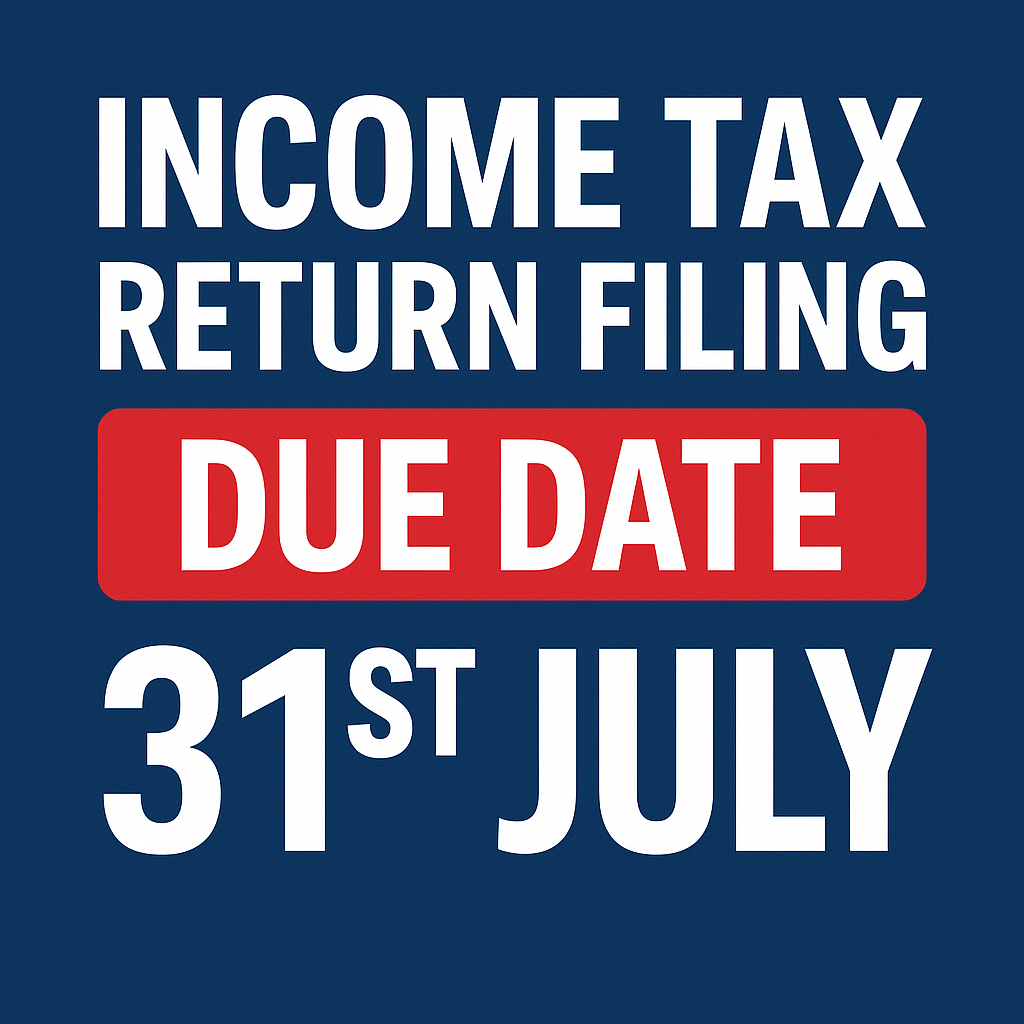

What is the Income Tax Return Filing Due Date?

For most individual taxpayer in India, the Income Tax Return Filing Due Date for the financial year 2024-25( Assessment Year 2025-26) is July 31 2025. This applies to :

• Individuals( salaried or self-employed) not requiring audit

. • Hindu Undivided families( HUFs)

. •Firms not under audit

However, if your accounts need to be audited( like in the case of certain of businesses or professionals) , the deadline usually extends to October 31,2025

But beware – while deadline can be extended in rare cases, relying on another extension is a risky game. It’s always better to be proactive than to rush at the last moment.

What Happens If you Miss the Due Date ?

Missing the ITR deadline can lead to:

• Late filing Fee under Section 234F( up to Rs.5,000)

• Interest Penalty on unpaid taxes

. • Loss of Carrry Forward of certain losses( like capital losses)

. • Delayed Refund( if you’re eligible for one)

•. Increased Scrutiny from the Income Tax Department.

In short, procrastination can cost you time, money and sleep!

Why File Early?

Fillin your ITR early isn’t just about beating the clock. It comes with real advantage:

• Faster refunds in case of excess tax paid

• Avoiding server issues during the last – minute rush

• Time to rectify errors or revise your return if needed

• peace of mind knowing you’re done with one of the most important financial tasks of the year.

•Documents You Need

. • PAN & Aadhaar card

. • Form 16(for salaried employees)

. • Form 26AS and AIS

. • Bank statements

. • Investment proofs

. • Details of capital gains,if any

. • Rental income details( if applicable)

rluq9u

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

download 888slot hỗ trợ đa thiết bị – đăng nhập cùng lúc trên điện thoại và máy tính mà không bị logout. TONY01-12

Actually, I had to find Doxycycline quickly and discovered Antibiotics Express. It allows you to get treatment fast legally. In case of UTI, this is the best place. Fast shipping to USA. Go here: https://antibioticsexpress.com/#. Good luck.

Recently, I had to find Ciprofloxacin without waiting and discovered a reliable pharmacy. They let you order meds no script safely. If you have sinusitis, this is the best place. Overnight shipping guaranteed. Visit here: view details. Good luck.

online med pharmacy on line pharmacy

https://myspace.com/gliderperiod64 rate canadian pharmacies

pharmacy open near me foreign online pharmacy

Lately, I was looking for Amoxil for a toothache and discovered Amoxicillin Express. It offers generic Amoxil with express shipping. For fast relief, highly recommended: buy amoxicillin online. Hope it helps.

Actually, I needed Ivermectin tablets and stumbled upon this reliable site. They provide generic Stromectol no script needed. For treating scabies safely, highly recommended: go here. Hope it helps

amoxicillin without a prescription cheap doxycycline online

http://www.qianqi.cloud/home.php?mod=space&uid=1072479 how much is amoxicillin prescription

cheap bactrim amoxicillin 500mg prescription

Selam, güvenilir casino siteleri arıyorsanız, bu siteye mutlaka göz atın. En iyi firmaları ve fırsatları sizin için listeledik. Güvenli oyun için doğru adres: bonus veren siteler iyi kazançlar.

Yeni Pin Up giriş ünvanını axtaranlar, bura baxa bilərsiniz. İşlək link vasitəsilə hesabınıza girin və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: Pin Up uğurlar.

Selamlar, güvenilir casino siteleri arıyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve bonusları sizin için inceledik. Dolandırılmamak için doğru adres: türkçe casino siteleri bol şanslar.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: canlı casino siteleri Hangi site güvenilir diye düşünmeyin. Onaylı casino siteleri listesi ile sorunsuz oynayın. Tüm liste linkte.

Pin Up Casino Azərbaycanda ən populyar kazino saytıdır. Saytda minlərlə oyun və Aviator var. Pulu kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt sayta keçid baxın.

Bu sene popüler olan casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için siteyi incele kazanmaya başlayın.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini gampang menang dan aman. Promo menarik menanti anda. Kunjungi: п»їBonaslot slot dan menangkan.

Yeni Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. İşlək link vasitəsilə hesabınıza girin və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: Pinup uğurlar.

Selamlar, güvenilir casino siteleri bulmak istiyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve fırsatları sizin için inceledik. Dolandırılmamak için doğru adres: listeyi gör iyi kazançlar.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: listeyi gör Nerede oynanır diye düşünmeyin. Onaylı casino siteleri listesi ile rahatça oynayın. Tüm liste linkte.

п»їHalo Slotter, cari situs slot yang mudah menang? Rekomendasi kami adalah Bonaslot. RTP Live tertinggi hari ini dan terbukti membayar. Isi saldo bisa pakai Dana tanpa potongan. Login disini: п»їBonaslot slot semoga maxwin.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan aman. Bonus new member menanti anda. Kunjungi: Bonaslot slot raih kemanangan.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan aman. Bonus new member menanti anda. Akses link: https://bonaslotind.us.com/# situs slot resmi raih kemanangan.

Yeni Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə hesabınıza girin və qazanmağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up online uğurlar.

2026 yılında en çok kazandıran casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Bedava bahis veren siteleri ve güncel giriş linklerini paylaşıyoruz. Hemen tıklayın bonus veren siteler fırsatı kaçırmayın.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini gampang menang dan resmi. Bonus new member menanti anda. Kunjungi: п»їbonaslotind.us.com dan menangkan.

Online slot oynamak isteyenler için kılavuz niteliğinde bir site: casino siteleri 2026 Hangi site güvenilir diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile sorunsuz oynayın. Detaylar linkte.

Aktual Pin Up giriş ünvanını axtaranlar, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə hesabınıza girin və oynamağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up rəsmi sayt uğurlar.

Info slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Bonus new member menanti anda. Kunjungi: Bonaslot slot dan menangkan.

Hər vaxtınız xeyir, əgər siz yaxşı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Sayta keçmək üçün link: Pin Up kazino uğurlar hər kəsə!

2026 yД±lД±nda en Г§ok kazandД±ran casino siteleri hangileri? CevabД± web sitemizde mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaЕџД±yoruz. Hemen tД±klayД±n п»їburaya tД±kla kazanmaya baЕџlayД±n.

Hər vaxtınız xeyir, əgər siz yaxşı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Ən yaxşı slotlar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Sayta keçmək üçün link: bura daxil olun uğurlar hər kəsə!

Halo Slotter, lagi nyari situs slot yang gacor? Rekomendasi kami adalah Bonaslot. Winrate tertinggi hari ini dan pasti bayar. Isi saldo bisa pakai Pulsa tanpa potongan. Daftar sekarang: login sekarang semoga maxwin.

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan aman. Bonus new member menanti anda. Akses link: п»їhttps://bonaslotind.us.com/# Bonaslot login raih kemanangan.

Bu sene popüler olan casino siteleri hangileri? Cevabı platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# cassiteleri.us.org kazanmaya başlayın.

Bu sene popüler olan casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın türkçe casino siteleri fırsatı kaçırmayın.

Salam dostlar, əgər siz yaxşı kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Canlı oyunlar və sürətli ödənişlər burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Sayta keçmək üçün link: https://pinupaz.jp.net/# sayta keçid uğurlar hər kəsə!

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: mobil ödeme bahis Nerede oynanır diye düşünmeyin. Editörlerimizin seçtiği bahis siteleri listesi ile rahatça oynayın. Tüm liste linkte.

Salamlar, siz də keyfiyyətli kazino axtarırsınızsa, məsləhətdir ki, Pin Up saytını yoxlayasınız. Canlı oyunlar və rahat pul çıxarışı burada mövcuddur. İndi qoşulun və ilk depozit bonusunu götürün. Daxil olmaq üçün link: pinupaz.jp.net uğurlar hər kəsə!

Bu sene popüler olan casino siteleri hangileri? Detaylı liste web sitemizde mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın en iyi casino siteleri fırsatı kaçırmayın.

Bu sene en Г§ok kazandД±ran casino siteleri hangileri? CevabД± platformumuzda mevcuttur. Bedava bahis veren siteleri ve gГјncel giriЕџ linklerini paylaЕџД±yoruz. Hemen tД±klayД±n п»їhttps://cassiteleri.us.org/# mobil Г¶deme bahis kazanmaya baЕџlayД±n.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: güvenilir casino siteleri Hangi site güvenilir diye düşünmeyin. Onaylı casino siteleri listesi ile rahatça oynayın. Detaylar linkte.

Pin Up kazino pinupaz.jp.net Pin Up yüklə and sayta keçid ətraflı məlumat

https://apunto.it/user/profile/552217 rəsmi sayt http://anime-fushigi.net/forum/away.php?s=http://pharmaexpressfrance.com ətraflı məlumat and http://www.xunlong.tv/en/orangepibbsen/home.php?mod=space&uid=6213609 bura daxil olun

Pin Up giriş Pin Up Azerbaijan ətraflı məlumat bura daxil olun or Pin Up online pinupaz.jp.net

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Bonus new member menanti anda. Kunjungi: Bonaslot raih kemanangan.

Selamlar, ödeme yapan casino siteleri bulmak istiyorsanız, bu siteye kesinlikle göz atın. En iyi firmaları ve bonusları sizin için inceledik. Dolandırılmamak için doğru adres: https://cassiteleri.us.org/# kaçak bahis siteleri bol şanslar.

Bocoran slot gacor hari ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Situs ini anti rungkad dan aman. Promo menarik menanti anda. Kunjungi: bonaslotind.us.com raih kemanangan.

Salam dostlar, siz də etibarlı kazino axtarırsınızsa, mütləq Pin Up saytını yoxlayasınız. Yüksək əmsallar və sürətli ödənişlər burada mövcuddur. Qeydiyyatdan keçin və ilk depozit bonusunu götürün. Daxil olmaq üçün link: https://pinupaz.jp.net/# pinupaz.jp.net uğurlar hər kəsə!

Bocoran slot gacor malam ini: mainkan Gate of Olympus atau Mahjong Ways di Bonaslot. Website ini anti rungkad dan resmi. Bonus new member menanti anda. Kunjungi: https://bonaslotind.us.com/# login sekarang raih kemanangan.

Yeni Pin Up giriş ünvanını axtaranlar, bura baxa bilərsiniz. Bloklanmayan link vasitəsilə qeydiyyat olun və qazanmağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: bura daxil olun hamıya bol şans.

Canlı casino oynamak isteyenler için rehber niteliğinde bir site: https://cassiteleri.us.org/# cassiteleri.us.org Hangi site güvenilir diye düşünmeyin. Editörlerimizin seçtiği casino siteleri listesi ile sorunsuz oynayın. Tüm liste linkte.

Bu sene en çok kazandıran casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Deneme bonusu veren siteleri ve yeni adres linklerini paylaşıyoruz. İncelemek için https://cassiteleri.us.org/# siteyi incele kazanmaya başlayın.

Bonaslot adalah bandar judi slot online terpercaya di Indonesia. Ribuan member sudah merasakan Jackpot sensasional disini. Transaksi super cepat hanya hitungan menit. Situs resmi п»їhttps://bonaslotind.us.com/# situs slot resmi jangan sampai ketinggalan.

Pin Up Casino Azərbaycanda ən populyar kazino saytıdır. Saytda çoxlu slotlar və canlı dilerlər var. Pulu kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Rəsmi sayt https://pinupaz.jp.net/# rəsmi sayt baxın.

Pin Up Casino ölkəmizdə ən populyar platformadır. Burada minlərlə oyun və Aviator var. Pulu kartınıza anında köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Rəsmi sayt Pin Up kazino yoxlayın.

Pin Up Casino ölkəmizdə ən populyar platformadır. Burada çoxlu slotlar və Aviator var. Qazancı kartınıza tez köçürürlər. Proqramı də var, telefondan oynamaq çox rahatdır. Giriş linki https://pinupaz.jp.net/# Pin Up tövsiyə edirəm.

Pin Up Casino ölkəmizdə ən populyar platformadır. Saytda çoxlu slotlar və canlı dilerlər var. Pulu kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki Pin Up yoxlayın.

Selamlar, ödeme yapan casino siteleri bulmak istiyorsanız, bu siteye mutlaka göz atın. Lisanslı firmaları ve bonusları sizin için listeledik. Güvenli oyun için doğru adres: listeyi gör iyi kazançlar.

Selamlar, güvenilir casino siteleri arıyorsanız, hazırladığımız listeye mutlaka göz atın. Lisanslı firmaları ve bonusları sizin için inceledik. Dolandırılmamak için doğru adres: listeyi gör bol şanslar.

Aktual Pin Up giriş ünvanını axtarırsınızsa, bura baxa bilərsiniz. İşlək link vasitəsilə qeydiyyat olun və oynamağa başlayın. Xoş gəldin bonusu sizi gözləyir. Keçid: https://pinupaz.jp.net/# Pin Up kazino hamıya bol şans.

Aktual Pin Up giriş ünvanını axtarırsınızsa, doğru yerdesiniz. İşlək link vasitəsilə hesabınıza girin və qazanmağa başlayın. Pulsuz fırlanmalar sizi gözləyir. Keçid: Pin Up AZ qazancınız bol olsun.

mexican rx mexican pharmacys and order medication from mexico tijuana pharmacy online

http://endersby.co.za/redirect/?url=https://pharm.mex.com mexipharmacy reviews and http://www.xunlong.tv/en/orangepibbsen/home.php?mod=space&uid=6219727 order medicine from mexico

mexican pharmacy las vegas mexico pharmacy price list or mexico online farmacia meds from mexico

Hey guys, Just now came across a great website for cheap meds. For those looking for medicines from India cheaply, this site is very reliable. You get secure delivery to USA. Check it out: read more. Best regards.

Dostlar selam, bu site oyuncular? ad?na k?sa bir duyuru paylas?yorum. Bildiginiz gibi platform adresini tekrar guncelledi. Giris sorunu yas?yorsan?z endise etmeyin. Guncel Vay Casino giris linki art?k asag?dad?r: https://vaycasino.us.com/# Bu link ile direkt hesab?n?za girebilirsiniz. Lisansl? casino deneyimi surdurmek icin Vaycasino dogru adres. Herkese bol kazanclar dilerim.

Link tải Sunwin Tải Sunwin sun win or sun win Tải Sunwin

https://telegra.ph/Tб»•ng-Hб»Јp-Link-VГ o-Casino-Trб»±c-Tuyбєїn-Tбє·ng-Tiб»Ѓn-CЖ°б»Јc-Miб»…n-PhГ-01-27 Game bài đổi thưởng http://www.onlineunitconversion.com/link.php?url=intimapharmafrance.com& Tải Sunwin or https://www.ixxxnxx.com/user/imdsqkhnpm/videos sunwin

sunwin Link tải Sunwin Sunwin web Tải Sunwin and Link tải Sunwin Game bài đổi thưởng

Game bài đổi thưởng Sunwin web sunwin or sunwin sun win

https://pin-it.space/item/558096 sunwin https://www.livecmc.com/?lang=fr&id=Ld9efT&url=https://homemaker.org.in:: Sunwin web and http://www.ktmoli.com/home.php?mod=space&uid=406891 Game bài đổi thưởng

sunwin Tải Sunwin Link tải Sunwin Sunwin web or sunwin Link tải Sunwin

Iver Protocols Guide: Iver Protocols Guide – stromectol nz

cheap propecia price: Follicle Insight – cost of propecia online

https://iver.us.com/# stromectol without prescription

AmiTrip AmiTrip Amitriptyline

https://fertilitypctguide.us.com/# fertility pct guide

https://fertilitypctguide.us.com/# buying cheap clomid

fertility pct guide: fertility pct guide – how to buy clomid without dr prescription

In terms of safety protocols, please review the official information page at: https://magmaxhealth.com/prilosec.html for clinical details.

zofran side effects: zofran generic – Nausea Care US

http://nauseacareus.com/# zofran dosage

tizanidine generic: Spasm Relief Protocols – methocarbamol medication

https://bajameddirect.com/# BajaMed Direct

onlinepharmaciescanada com: online canadian pharmacy review – canadian pharmacy sildenafil

stromectol oral ivermectin lotion price ivermectin 1 cream generic and ivermectin 10 ml stromectol ivermectin

https://controlc.com/be0d9546 ivermectin oral 0 8 https://toolbarqueries.google.com.tr/url?q=https://ivertherapeutics.shop ivermectin 2ml or http://dnp-malinovka.ru/user/stchygdtgv/?um_action=edit ivermectin brand

ivermectin lotion price buy ivermectin pills ivermectin 1 cream stromectol over the counter and stromectol online canada buy ivermectin nz

https://ivertherapeutics.com/# ivermectin tablets

pharmacy order online legit canadian online pharmacy and professional pharmacy canadian pharmacy cialis reviews

https://www.google.com.sv/url?q=https://smartgenrxusa.shop pharmacy discount card or http://1f40forum.bunbun000.com/bbs/home.php?mod=space&uid=9757169 best canadian online pharmacy

reliable rx pharmacy online pharmacy birth control pills and online pharmacy products discount pharmacy

http://neuroreliefusa.com/# gabapentin generic

https://ivertherapeutics.com/# Iver Therapeutics

https://smartgenrxusa.shop/# pharmacy com canada

http://ivertherapeutics.com/# ivermectin 2%

http://ivertherapeutics.com/# Iver Therapeutics

http://neuroreliefusa.com/# Neuro Relief USA

https://smartgenrxusa.com/# cheap scripts pharmacy

http://smartgenrxusa.com/# Smart GenRx USA

https://neuroreliefusa.com/# neurontin 300mg capsule

http://smartgenrxusa.com/# Smart GenRx USA

https://sertralineusa.shop/# zoloft pill

https://smartgenrxusa.shop/# Smart GenRx USA